Understanding unit economics and overhead is crucial for businesses to maintain profitability. In this blog, we break down how these two components impact financial health, pricing strategies, cost management, and scalability. Learn how mastering unit economics can help you achieve sustainable growth while effectively managing overhead costs.

On this page

Unit Economics: The Foundation of Profitability

Overhead: The Operational Backbone

The Interplay Between Unit Economics and Overhead

Conclusion

In the complex world of business finance, two critical concepts stand out for their importance in determining a company's financial health and potential for growth. They are unit economics and overhead. Let’s break them down so you don’t lose your head!

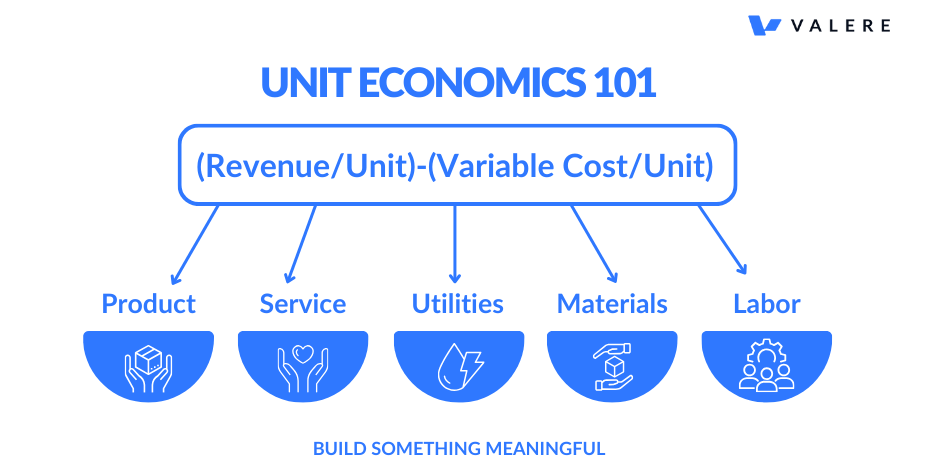

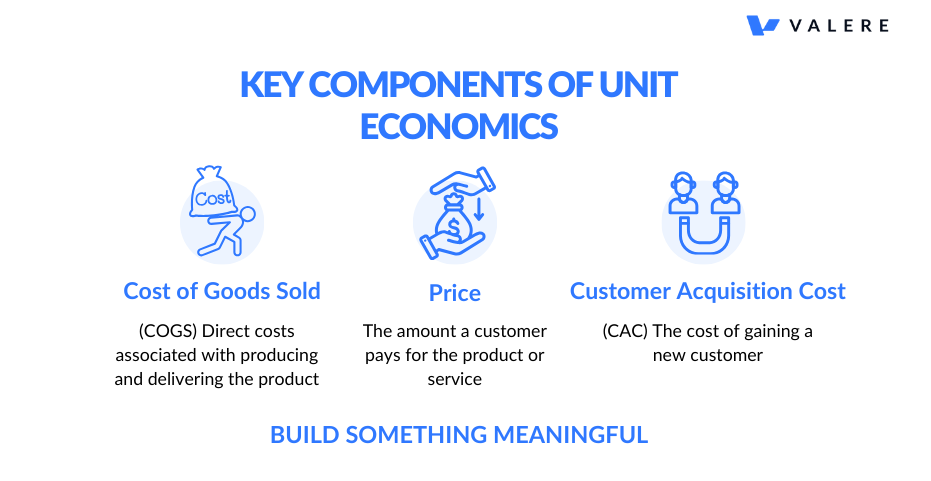

Unit economics is a crucial metric that focuses on the profitability of a single unit of product or service. It's essentially a measure of the direct revenues and costs associated with a particular business model on a per-unit basis. Understanding unit economics is vital for businesses to ensure that they're making a profit on each sale before considering broader operational costs.

Unit economics are like running a lemonade stand. You track your costs (lemons, sugar, cups) and your sales (each cup sold) to see if you're making money on each glass. Just like with lemonade, understanding unit economics helps businesses avoid selling things for less than it costs to make them!

Let's break down unit economics with a numeric example to bring this full circle:

Company X sells baseball bats, and the price of one baseball bat is $100. Manufacturing, shipping, and acquiring a customer for one bat costs $30. Making our unit economic calculation: $100 - $30 = $70 profit per unit.

In this scenario, the unit economics are positive, indicating that each sale contributes $70 towards covering other business expenses and potentially generating profit.

While unit economics focuses on individual sales, overhead encompasses the fixed costs that a business incurs regardless of its sales volume. These are expenses that don't directly tie to the production or sale of individual units but are necessary for the overall operation of the business.

Common overhead expenses include:

It's crucial to note that overhead costs are not included in unit economics calculations. They represent a separate category of expenses that must be covered by the cumulative profits generated from unit sales.

To determine overall business profitability, companies must consider both unit economics and overhead:

A business with positive unit economics may still struggle if its overhead costs are too high. Conversely, a company might have manageable overhead but poor unit economics, making it difficult to achieve profitability.

Understanding both unit economics and overhead is crucial for several reasons:

Unit economics and overhead are two sides of the same coin in business finance. While unit economics provides insight into the profitability of individual sales, overhead represents the ongoing costs of running the business. By carefully managing both aspects, businesses can ensure they're not only making money on each sale but also covering their operational costs and generating overall profit.

A deep understanding of these concepts is essential for entrepreneurs and business managers. It allows for informed decision-making, from pricing strategies to operational efficiencies, ultimately leading to a more sustainable and profitable business model. As markets evolve and competition intensifies, mastering the interplay between unit economics and overhead can be the key to long-term success and growth.

Interested in Business and Entrepreneurship?

Stay ahead with insights and tips by following Guy on LinkedIn. Connect with his content and elevate your entrepreneurial journey today!

Share